Stone finishing tools are essential for terrazzo and concrete contractors, providing the precision and quality necessary to achieve flawless, long-lasting surfaces. Whether you’re working on large-scale commercial projects or small residential installations, having the right tools can make all the difference in both the final appearance and durability of the work.

As a trusted stone finishing tools exporter, we understand the unique demands of terrazzo and concrete contractors. These materials are not only durable but also require special care when it comes to finishing and polishing. That’s where high-quality stone finishing tools come into play, ensuring that every surface is smooth, even, and visually appealing.

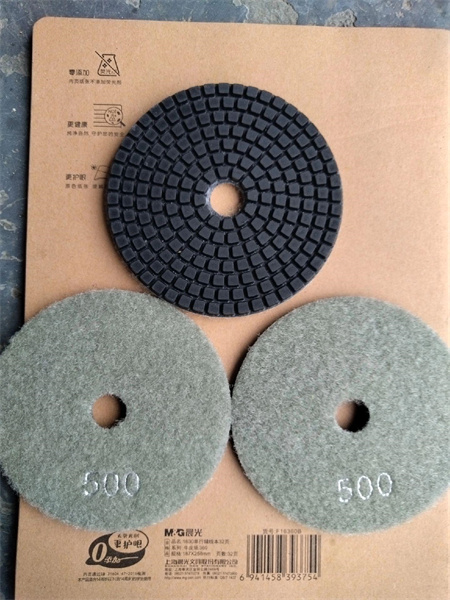

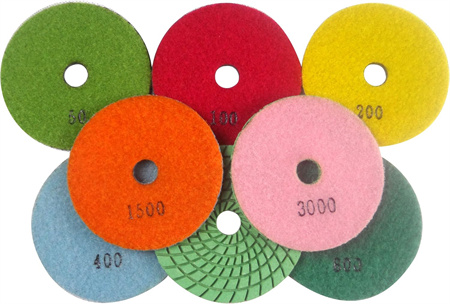

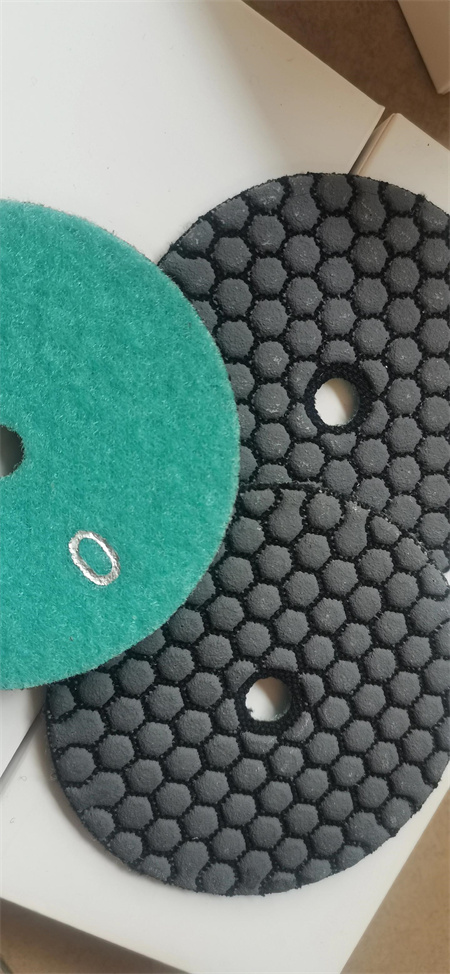

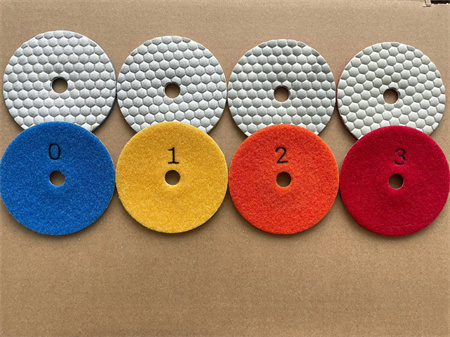

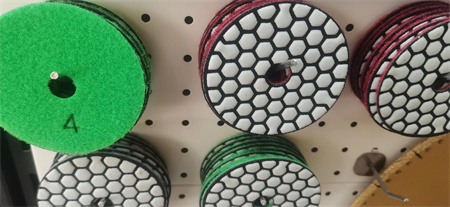

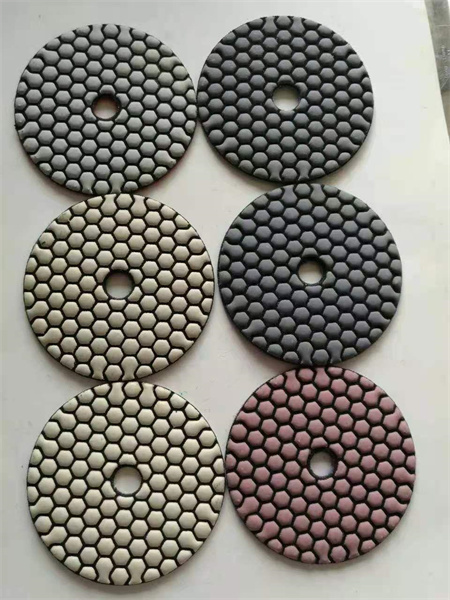

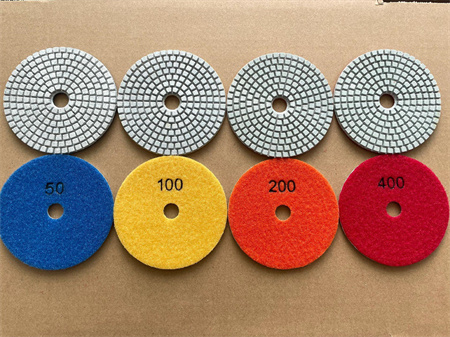

Our range of products includes diamond polishing pads, grinding wheels, and diamond blades, all designed to handle the toughest stone materials. These tools are built to offer consistent performance, helping contractors achieve a high-quality finish that exceeds client expectations. For terrazzo work, our tools allow contractors to bring out the material’s unique beauty by smoothing the surface to perfection. For concrete projects, they ensure an even, polished finish that is resistant to wear and tear, even in high-traffic areas.

The durability of our tools is matched only by their ease of use. We know that contractors rely on their equipment to deliver optimal results in tight timelines, so our products are engineered for both efficiency and comfort. Whether you’re polishing a terrazzo floor or smoothing a freshly poured concrete slab, our tools reduce the amount of time spent on each task, boosting productivity and ultimately lowering project costs.

Quality and reliability are our top priorities. As an exporter, we source only the finest materials to manufacture our stone finishing tools, ensuring that each product stands up to the demanding conditions of professional construction environments. Our commitment to excellence means that contractors can trust our tools to deliver superior results on every job.

With our stone finishing tools, terrazzo and concrete contractors gain the confidence they need to tackle even the most complex finishing projects. The combination of precision, durability, and ease of use makes our tools the go-to choice for professionals who demand the best. Whether you’re working on a sleek terrazzo installation or a robust concrete floor, our products help you achieve perfection in every detail.